A gold IRA rollover describes the procedure of transferring funds from a standard IRA (Individual Retirement Account) right into a self-directed IRA that enables you to invest in physical gold or various other rare-earth elements.

If you’re carefully planning for your gold years, it’s most likely that you have a dedicated retirement savings account such as a 401( k) or individual retirement account. ira to gold These accounts use a convenient method to spend your funds for the future, while likewise giving appealing tax benefits. However, there’s a lesser-known sort of retirement account that you might not know with: a gold individual retirement account.

Gold IRAs work the same as standard and Roth IRAs, however they also permit you to capitalize on the many benefits of gold investing, including diversity, security from rising cost of living and secure returns. If you’re looking to bolster your retired life cost savings, it’s worth thinking about rolling over your funds from an existing retirement account to a gold IRA.

Discover more about buying a gold individual retirement account with this free info package.

A gold IRA rollover is a monetary technique that includes changing funds from a traditional individual retirement account or 401( k) to a self-directed individual retirement account, which supplies the choice to invest in alternate possessions like gold, silver, platinum, and palladium. This step allows people to diversify their retired life portfolio beyond the traditional stocks, bonds, and mutual funds, and possibly protect their savings versus financial unpredictabilities.

You have the choice to carry out a direct rollover, where the entity holding your existing pension transferred funds directly to your brand-new gold individual retirement account. Conversely, you can select an indirect rollover, where you withdraw funds from your bank account and down payment them into the new one directly.

Direct rollovers are much faster and are 100% tax- and penalty-free. If you opt for an indirect rollover, you have 60 days from the time you receive the funds from your old account to the time you put them right into your brand-new account. If you do not finish the rollover within these 60 days, the IRS considers it a distribution or withdrawal. You’ll be exhausted on it, and you’ll additionally encounter a 10% early withdrawal charge if you’re under 59 1/2.

A gold IRA rollover uses the benefit of stability during times of financial unpredictability, as gold has a tried and tested record of holding its value despite financial downturns.

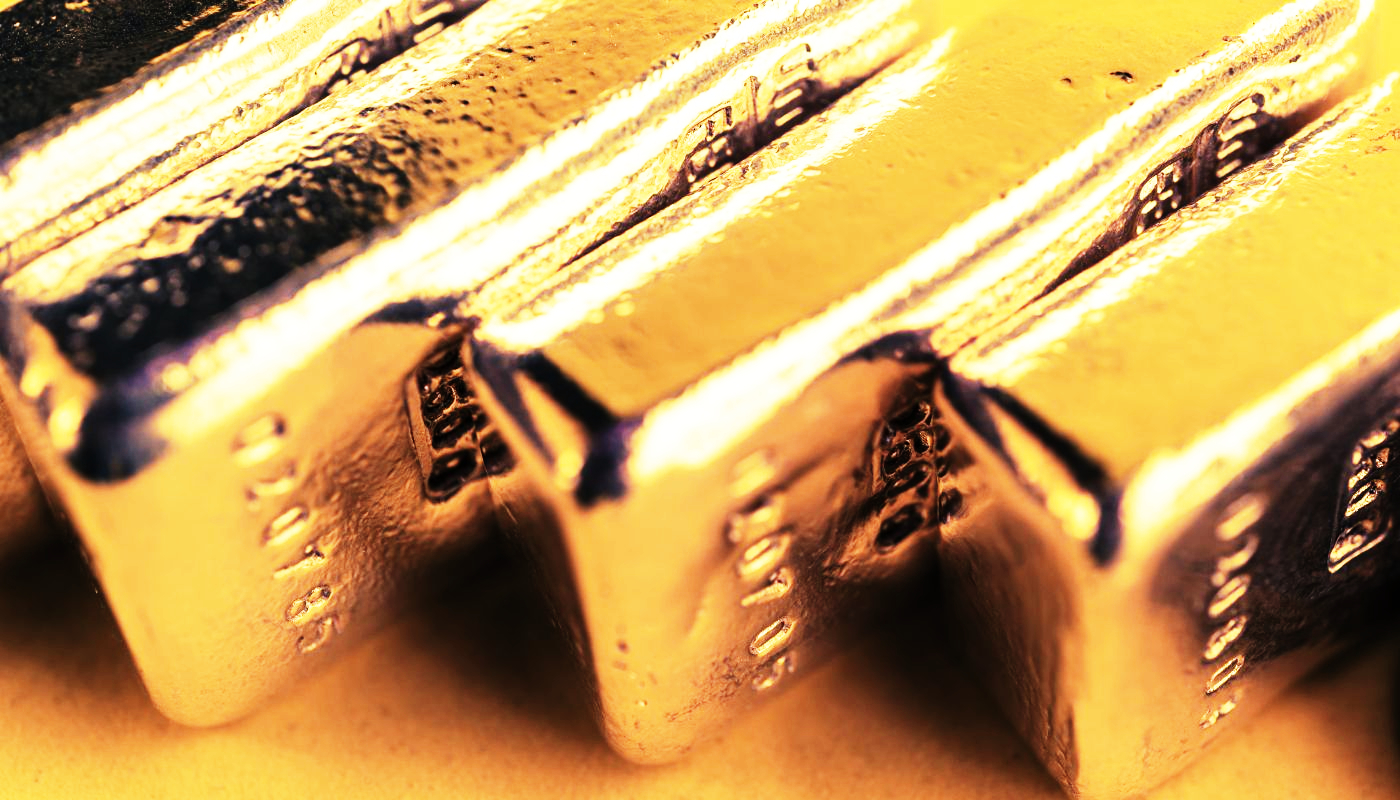

Gold has actually long been considered as a safe haven throughout times of monetary dilemma, as it often tends to hold its worth ( otherwise increase in value) when the economic climate is shaky. Unlike traditional investments, gold and other rare-earth elements maintain a fairly steady worth despite periods of rising cost of living, geopolitical instability and market volatility.

In addition, gold is adversely correlated with properties like stocks, which indicates that its value tends to go up when these assets go down. This can decrease your threat exposure and help you keep your retirement savings when conventional assets are underperforming.

Get going by requesting your complimentary gold investors kit online today!

What to think about before choosing a gold individual retirement account rollover

Before choosing a gold IRA rollover, make sure you understand any type of expenses entailed. Gold IRAs come with charges you may not have with various other pension, including storage space and insurance policy fees, custodian costs and the premium you’ll pay for physical gold. Make certain to take these right into account, as they will certainly influence your profits.

How to establish a gold IRA rollover

To begin a gold individual retirement account rollover, you initially need to locate a reputable gold IRA custodian to hold your gold possessions and manage your account. Seek one with a solid record, reasonable fees and a lot of favorable client feedback.

You will certainly after that deal with the custodian to move funds from your existing pension into your brand-new self-directed gold IRA. Once the account is established, you can start dealing gold via this account.

You can choose to purchase either gold bars and coins or exchange-traded funds (ETFs) that track the costs of gold. Your IRA custodian will certainly manage all the needed paperwork and make certain every little thing is done according to IRS laws. They will certainly likewise keep your physical gold in a safe center.

The bottom line

A gold individual retirement account is a effective tool that integrates the tax benefits of conventional pension with the benefits of purchasing gold. And if you already have funds in a conventional account like a 401(k) or IRA, moving those funds over right into a gold IRA is a rather straightforward procedure.

Of course, prior to making any financial investment choice, it is very important to meticulously consider the advantages and disadvantages and consult with a economic advisor to establish the path that finest fits your private demands and objectives. With the ideal plan in place, a gold individual retirement account rollover can be a useful enhancement to your financial investment method.